If you’re only able to identify three months of spending, you want to multiply the total to give you an estimated annual total. You’ll add all the receipts and/or expenses together for a total in each category. But you can change or add new categories as desired.Īfter you’ve determined the spending categories you want, you will enter them into the Spending Planner.

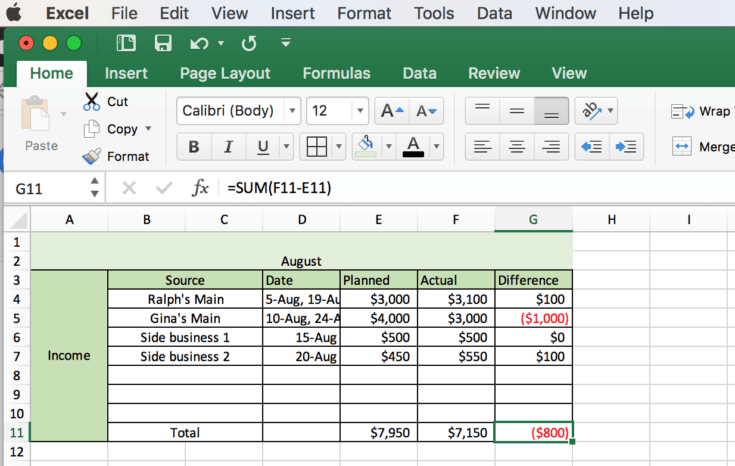

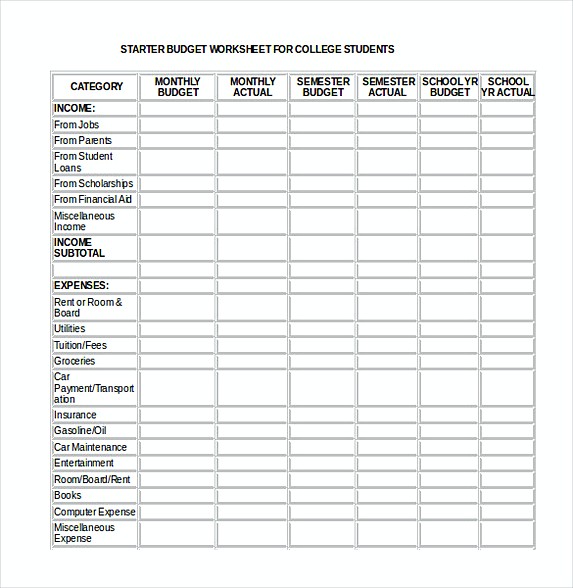

#Excel budget spreadsheet template for mac software#

The software includes sample categories to aid you in creating appropriate titles for your various areas of spending. You know, things like housing, transportation, food, etc. You may establish as many categories as you like. You do this by examining how you spent money over the last 12 months. You’ll determine “spending categories” that you will use to project your expenditures. Then you’ll do the same thing with expenses. Once you’ve entered the projected tax amount, your total projected spendable monthly income is automatically calculated for you. You’ll calculate the taxes for the projected income by using the same percentage of taxes withheld from your current income. You can project income by looking at the last 12 months of income and adjusting for anticipated changes. You’ll determine your projected income by inputting expected increases or other additional types of income. This amount will change as you deduct other amounts withheld from your paycheck. Once you’ve entered the tax amount, your total current spendable monthly income will be displayed. Don’t include other withholding items such as 401(k), insurance, etc. You want to be sure to include federal, state, and FICA taxes. You’ll determine tax amounts being withheld from your paychecks, or calculate your monthly tax rate from quarterly or annual tax filings. If you’re a two-income household, you’ll enter two incomes separately.

In using the Spending Planner, you’ll go through certain steps. Almost all the calculations you need are done automatically. It will give you a clear picture of how and where you spend your money. The planner is an important part of learning to control your finances. Once you’ve created a plan, the next step is to launch the “Spending Planner” software.

It’s going to be the cornerstone of your personal budget So after you’ve gathered the necessary information, you create a “plan.” A plan is a complete set of debt items and savings items that includes information about how you spend money, an estimated retirement age (the age at which you want to be financially free), current and projected tax rates, and a forecast of savings. The system consists of audio CDs, software, and a supply of what they call “ Spending Booklets.” You don’t need human help, you need resource help to develop an effective budget.įor personal budgets, I like a money management system called Money Mastery ( money mastery ). I’m talking about the kind of help you can implement yourself. Not the I’ll-sell-you-investments-for-a-commission kind of help or the I-do-financial-planning-for-a-fee kind of help. Here’s where I suggest you get some help. It starts with the information about your current spending, debt load, and savings, and investments. Once you’ve gathered the necessary information, you’re ready to create a personal budget. 3-month CD)Ĭurrent life insurance, Information about any pension funds, qualified retirement plans or capital gains Gather all current information on savings, investments, and insuranceĬurrent interest rates (annual rates) on all investmentsĬurrent balance and predefined length of the investment (ex.

0 kommentar(er)

0 kommentar(er)